Establishing Credit When You Have No Credit History

How to Build Up Your Credit with Your Credit Card

08/20/2021

2022 Nissan Ariya

09/15/2021It’s a comment situation many young adults face when they’re just starting out their financial life – how to build up credit from the ground up. After all, you can’t show that you’ve demonstrated responsible credit behavior when a lack of credit history means you can’t get credit ( Loan or unsecured credit card ). However, there are a handful of options to help you establish your credit history.

Consider a secured credit card. A secured credit card requires you to make a deposit when you apply, the deposit most likely will be the same amount as your applied credit limit. You can use secured credit cards just like a normal (unsecured) credit card – to make purchases and make regular payments. In that way, you are building up your credit history. However, if you fail to pay the full balance or minimum payment of your credit card off each billing cycle, the credit card company will send a late payment record to both credit bureaus, which will haunt your credit history. And when you close the account, you receive your deposit back, minus any outstanding balance and fees.

Because a secured credit card is meant to help consumers establish a credit history, it’s not meant for long-term use. Ask whether your credit card company reports to the two nationwide credit bureaus – Equifax and TransUnion. If they do not, the secured credit card will not help establish a credit history. Also, after 6 months of on-time payment history you can apply for an unsecured credit card that can establish your credit history ever faster but the same rule of thumb, pay off your credit card balances every billing cycle.

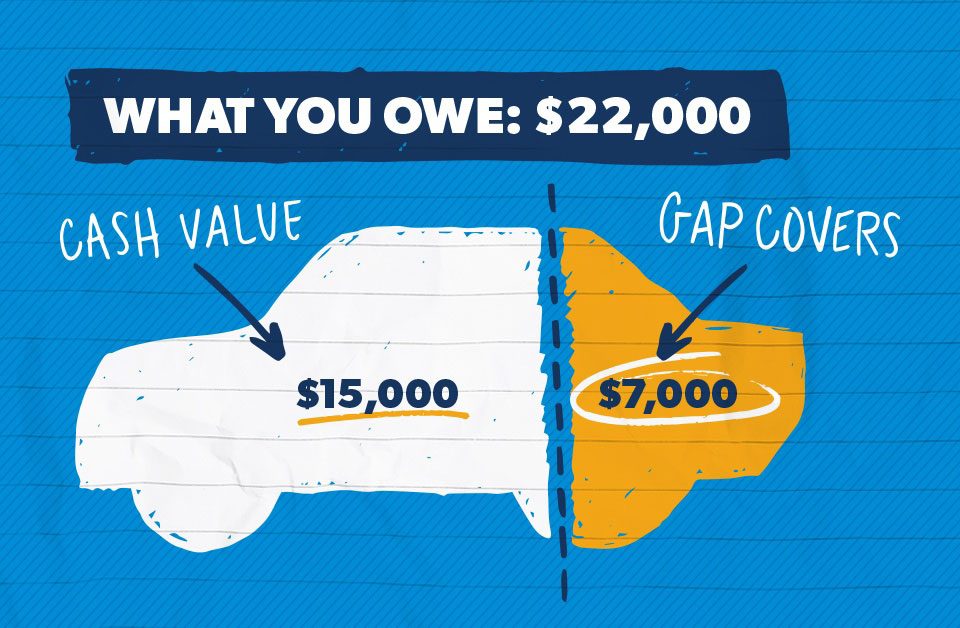

Consider a secured loan. A secured loan is a loan backed by an asset you own which is most frequently an automobile or real estate. If you don’t have any credit history, it will be hard for you to get a secured loan. However, most banks in Canada offer first-time buyer’s programs for people who are taking their first secured loan with one conditional requirement – 10% to 20% down payment on the automobile or real estate’s purchase price. Another way to get a secured loan is to get a co-signer on board with you, the co-signer must have a good credit history. A co-signer is a person who agrees to be legally responsible to pay a debt if the borrower does not pay back a loan as agreed. One common scenario is for parents to co-sign for their children’s first loan. Benefits of having a co-signer for your first loan may include better loan terms or qualifying for a loan you might not otherwise get.

However, it’s not an agreement to enter into lightly. Failing to make payments on the loan can impact both your credit and your co-signer’s credit.

Establishing a credit history takes time, so don’t expect things to change dramatically overnight. But month by month, responsible credit habits will translate into a positive credit history.