Highlights:

- Credit scores are designed to predict the likelihood that individuals will pay their bills as agreed

- Credit scores are only one of several pieces of information used to determine your creditworthiness.

- Payment history, the amount of credit you are using, and the length of your credit history are factors included in calculating your credit scores.

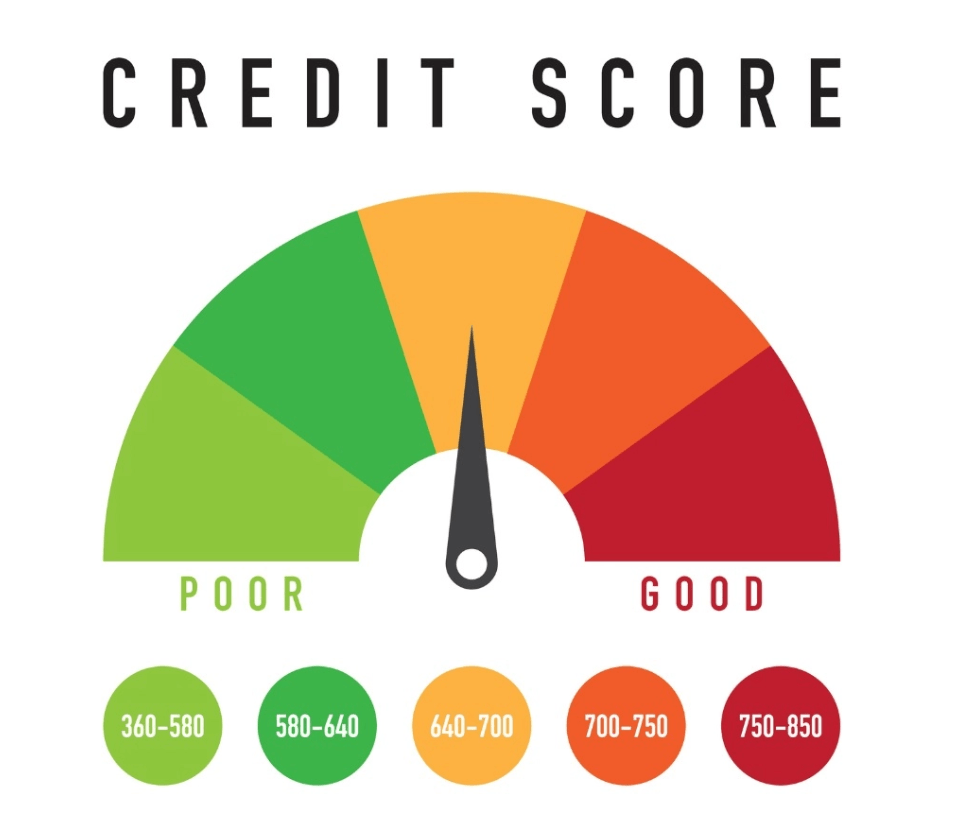

Credit scores are intended to help financial risk managers and others make fair decisions on whether or not to “take a risk” on someone. The risk might involve giving that person a loan (will they repay it?), offering a credit card (will they make the payments?) or approving their apartment rental application (will they pay their rent?). Credit scores are designed to predict the likelihood that individuals will pay their bills as agreed.

While your credit score is important, it is only one of several pieces of information an organization will use to determine your creditworthiness. For example, a lender would want to know your income as well as other information in addition to your credit score before it makes a decision.

The main factors involved in calculating a credit score are:

- Your payment history

- Your used credit vs. your available credit

- The length of your credit history

- Public records

- Number of inquiries into your credit file

If you look at your credit scores based on data from both national credit reporting agencies – Equifax and TransUnion – you may see different scores. This is completely normal. Each credit bureau has multiple scoring algorithms and lenders typically request only one of them when making decisions. While all score versions have the same purpose (to predict the likelihood people will pay their bills), there are some differences in the calculations.

There are many different scoring models and here is a general breakdown of the factors the models consider:

- Payment history: ~35%

Your credit history includes information about how you have repaid the credit you have already been extended on credit accounts such as credit cards, lines of credit, retail department store accounts, installment loans, auto loans, student loans, finance company accounts, home equity loans and mortgage loans for primary, secondary, vacation and investment properties.

In addition to reporting the number and type of credit accounts that you’ve paid on time, this category also includes details on late or missed payments, public record items and collection information. Credit scoring models look at how late your payments were, how much was owed, and how recently and how often you missed a payment. Your credit history will also detail how many of your credit accounts are delinquent in relation to all your accounts on file. For example, if you have 10 credit accounts (known as “tradelines” in the credit industry), and you have had a late payment in 5 of those accounts, that ratio may impact your credit score.

- Used credit vs. available credit: ~30%

A key part of your credit score analyzes how much of the total available credit is being used on your credit cards, as well as any other revolving lines of credit. A revolving line of credit is a type of loan that allows you to borrow, repay, and then reuse the credit line up to its available limit.

Also included in this factor is the total line of credit or credit limit. This is the maximum amount you could charge against a particular credit account, say $2,500 on a credit card.

- Credit history: ~15%

This section of your credit file details how long your credit accounts have been in existence. The credit score calculation typically includes both how long your oldest and most recent accounts have been open. In general, creditors like to see that you have been able to properly handle credit accounts over a period of time.

- Public Records: ~10%

Those who have a prior history of bankruptcy or have had collection issues or other derogatory public records may be considered risky. The presence of these events may have a significant negative impact on a credit score.

- Inquiries: ~10%

Anytime an individual’s credit file is accessed for any reason, the request for information is logged on the file as an inquiry. Inquiries require the consent of the individual and some may affect the individual’s credit score calculation. The only inquiries which may impact a credit score are those related to active credit seeking (such as applying for a new loan or credit card). These inquiries are known in industry jargon as “hard pulls” or “hard hits” on your credit file. The hard inquiry may be the leading indicator, the first sign of financial distress that appears on the credit file. Of course, not every inquiry is a sign of financial difficulty, and only a number of recent inquiries, in combination with other warning signals on the credit file should lead to a significant decline in a credit score.

Your credit score does not consider requests a creditor has made for your credit file or credit score to make a pre-approved credit offer, or to review your account with them, nor does it consider your own request for a copy of your credit history. These are some examples of “soft inquiries” or “soft pulls” of your credit.